Tired of being stuck between sky-high appliance prices and endless monthly rental fees? We’re breaking down the real costs, hidden fees, and smart strategies that savvy Burnaby homeowners use to make the appliance rental vs buying decision that actually saves money.

Picture this: you’re standing in your empty Burnaby apartment, staring at the vacant kitchen where a fridge should be, while your bank account screams from the recent damage of first month’s rent, last month’s rent, and that security deposit. Sound familiar? You’re definitely not alone in this struggle. With Burnaby’s rental market tighter than a pickle jar and housing costs eating up nearly 40% of most people’s income, every financial decision feels like it could make or break your monthly budget.

The appliance dilemma hits different when you’re living in one of Canada’s most expensive housing markets. Do you drop $2,000+ on a fridge and washer combo that you might have to ditch when your lease expires? Or do you go the rental route and potentially pay way more in the long run? The answer isn’t as straightforward as your parents’ “just buy it once” advice might suggest. Today’s housing reality—especially here in Burnaby—has completely flipped the script on appliance ownership.

What makes this decision even trickier is that both options come with sneaky costs that nobody talks about upfront. That “cheap” monthly rental fee? Yeah, it doesn’t include the delivery charges, security deposits, and potential early termination penalties. And that “economical” purchase? Try factoring in repair costs, moving expenses, and the fact that appliance maintenance plans have become practically essential in our throwaway economy.

Key Outtakes:

- Renting appliances typically makes financial sense for stays under 2-3 years, while buying becomes cost-effective for longer commitments

- Hidden costs like delivery fees ($50-150), security deposits ($100-200), and early termination penalties can significantly impact your rental budget

- Energy-efficient purchased appliances can save $300-550 over their lifetime compared to standard rental units

- Burnaby’s high renter population (38% of households) and housing mobility make appliance rentals particularly attractive for temporary residents

- Monthly rental costs typically range from $60-150 per appliance, accumulating to 15-25% of purchase prices annually

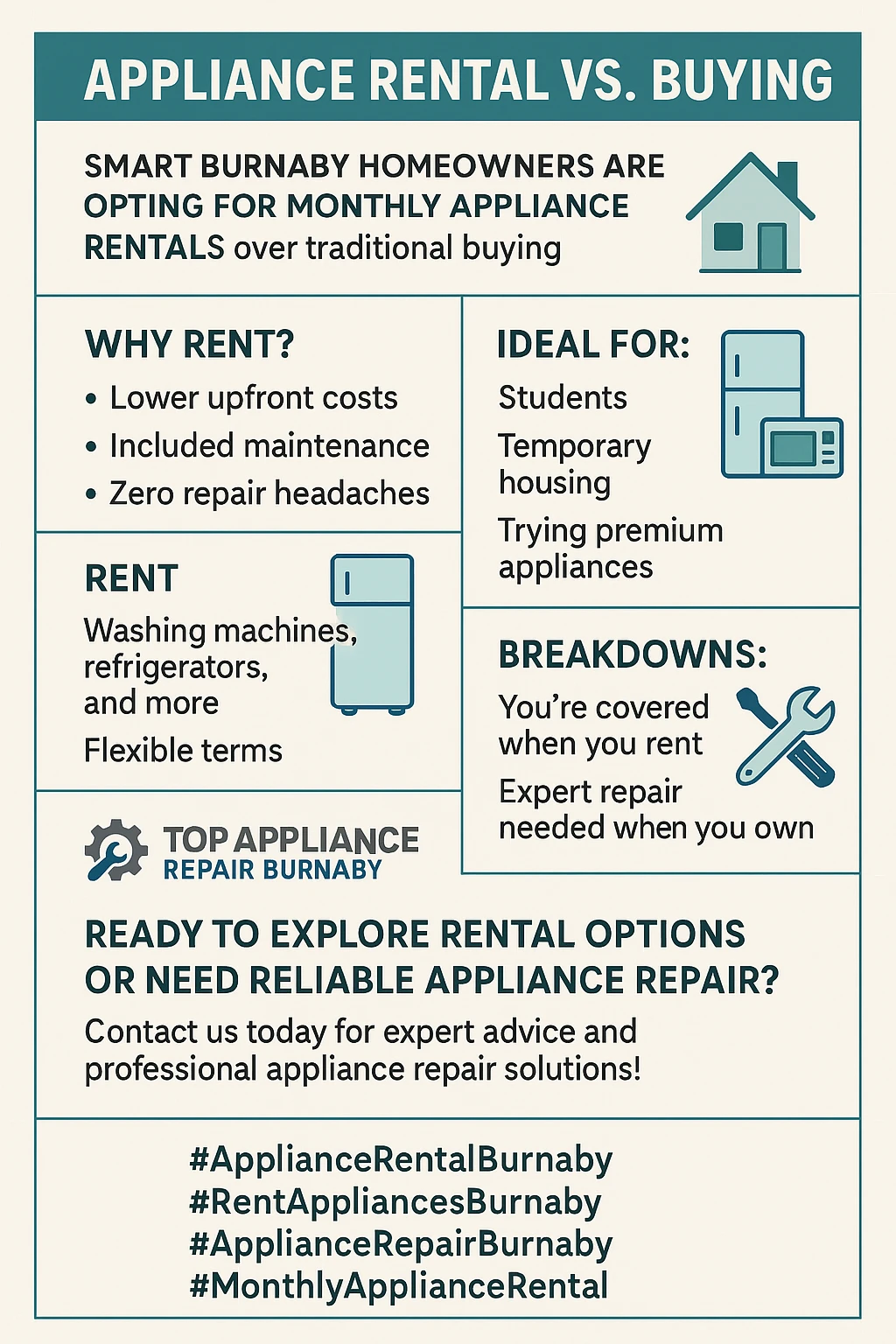

Why Burnaby Homeowners Are Rethinking Appliance Ownership

Let’s get real about what’s actually driving this shift toward appliance rentals in Burnaby. It’s not just about being trendy or following some millennial lifestyle trend—though that’s definitely part of it. The fundamental economics of living in Metro Vancouver have created a perfect storm where traditional “buy once, own forever” thinking simply doesn’t match most people’s actual life situations anymore.

The numbers tell a pretty compelling story here. With median renter household income sitting at around $45,839 in Burnaby while median rent for a one-bedroom pushes past $2,300, every dollar counts in ways our parents never had to consider. When nearly 37% of renter households are dealing with unaffordable housing costs, spending thousands upfront on appliances that might get left behind during the next move feels financially reckless rather than financially responsible.

But here’s where it gets interesting—this isn’t just about broke college students furnishing their first apartments anymore. Young professionals earning decent salaries are choosing rentals because they’re optimizing for flexibility rather than ownership. They’ve watched friends lose hundreds or thousands of dollars trying to sell used appliances during job relocations, or worse, having to abandon perfectly good equipment because moving costs made transport impossible. The sharing economy mindset that normalized Uber and Airbnb has extended into major household purchases, and appliance rental companies have stepped up their game to meet this demand.

The local infrastructure has evolved to match this demand too. Home Depot’s Burnaby location at 3950 Henning Drive offers tool and equipment rentals with flexible terms from 4-hour to monthly periods, recognizing that consumers want options beyond permanent ownership. Even smaller operations like Acme Prop Shop are getting into the appliance game, offering everything from mini fridges to full kitchen setups for weekly or monthly rental periods.

What’s particularly smart about how Burnaby residents are approaching this decision is that they’re treating appliances like any other major expense—they’re running the numbers based on their actual living situation rather than making emotional purchases. A tech worker on a two-year contract isn’t thinking about appliance ownership the same way someone buying their forever home would, and that’s exactly the kind of strategic thinking that leads to better financial outcomes.

The Real Cost Breakdown: Monthly Rentals vs Purchase Prices

Time for some real talk about the numbers, because this is where most people either save themselves serious money or accidentally blow their budgets without realizing it. The surface-level comparison seems pretty straightforward—monthly rental payments versus upfront purchase costs—but dig deeper and you’ll find more variables than a calculus textbook.

Let’s start with a realistic scenario that probably matches your situation. You need a decent fridge and a washer/dryer combo for your Burnaby apartment. Buying new, you’re looking at roughly $1,200 for a mid-range refrigerator and another $1,500 for a washer and dryer set. That’s $2,700 upfront—money that most people don’t just have lying around, especially after dropping thousands on moving expenses and housing deposits. The rental alternative runs about $80-120 monthly for the fridge and $100-180 combined for the washer and dryer, depending on the models and features you choose.

Here’s where the math gets interesting. Over 12 months, you’d pay roughly $2,160-3,600 in rental fees, which starts approaching purchase costs but doesn’t include the upfront security deposits (typically $100-200 per appliance) and delivery charges ($50-150). So your first-year rental cost might actually hit $2,500-4,200 once you factor in all the extras that rental companies don’t advertise prominently in their marketing.

But wait, there’s more! The purchase route has its own hidden costs that can completely change the equation. Unless you’re buying with cash, you’re probably financing the purchase, which adds interest charges. Then there’s delivery and installation (yes, you pay for this with purchases too), extended warranties that actually make sense for expensive appliances, and the biggie that nobody talks about—repair and maintenance costs that kick in after the manufacturer’s warranty expires.

The sweet spot analysis shows that renting makes clear financial sense for periods under 18-24 months, while buying becomes advantageous somewhere in the 2-3 year range, depending on specific costs and usage patterns. But here’s the kicker—most Burnaby renters move within 2-3 years anyway, making the rental option financially optimal for a significant portion of residents. When you factor in the hassle and cost of moving large appliances, plus the depreciation hit if you need to sell them, renting starts looking pretty smart even for slightly longer stays.

Energy efficiency throws another wrench into the calculation that most people completely overlook. Energy-efficient appliances can save $300-550 over their lifetime, but rental companies typically stock mid-range models rather than premium energy-efficient units. So while your monthly rental payment might be lower, your BC Hydro bill could be $20-40 higher per month compared to owning a high-efficiency model. Over a few years, that difference can completely flip which option actually costs less.

When Monthly Rentals Make Perfect Financial Sense

Understanding when appliance rental becomes the clear winner requires looking beyond just the monthly payment comparison and considering your actual life situation. The rental option shines brightest in specific scenarios that are incredibly common among Burnaby residents, especially those navigating the region’s challenging housing market dynamics.

Students and young professionals top the list of people who should almost always choose renting. If you’re in university, college, or just starting your career, the likelihood of residential stability beyond two years is pretty low. You might finish your program, land a job in another city, get accepted to grad school, or simply outgrow your current living situation. In these